A stop-loss order is an automated instruction to close a trade when it reaches a predefined loss level, helping minimize losses.

Trading with

Confidence, Winning

with FxTRAY!...

Navigating Markets, Maximizing Profits.

Phone: +447418379273 Start NowRisk Management and Analysis

Risk management and analysis are fundamental aspects of successful trading and investment. These processes help traders identify, assess, and mitigate risks to safeguard their investments and achieve sustainable profitability. Here's a comprehensive guide to understanding and implementing effective risk management strategies.

What is Risk Management?

Risk management involves identifying potential risks in trading, evaluating their impact, and applying strategies to minimize potential losses. It is essential for maintaining capital and ensuring long-term success in the financial markets.

01

Risk Identification

Understanding factors like market volatility, liquidity risks, and economics.

Risk Identification

Understanding factors like market volatility, liquidity risks, and economics.

02

Risk Assessment

Measuring the potential impact of identified risks on your trades...

Risk Assessment

Measuring the potential impact of identified risks on your trades in the market.

03

Risk Mitigation

Implementing strategies such as stop-loss orders, diversification, and sizing.

Risk Mitigation

Implementing strategies such as stop-loss orders, diversification, and sizing.

04

Risk-Reward Ratio

Calculate potential gains versus potential losses for every trade. A...

Risk-Reward Ratio

Calculate potential gains versus potential losses for every trade. A favorable ratio, like 2:1, ensures profits outweigh losses.

- Evaluating Your Progress

- Continuous Improvement

- 24/7 Customer Support

- Evaluating Your Progress

- Continuous Improvement

- 24/7 Customer Support

- Evaluating Your Progress

Tools and Techniques for Risk Analysis

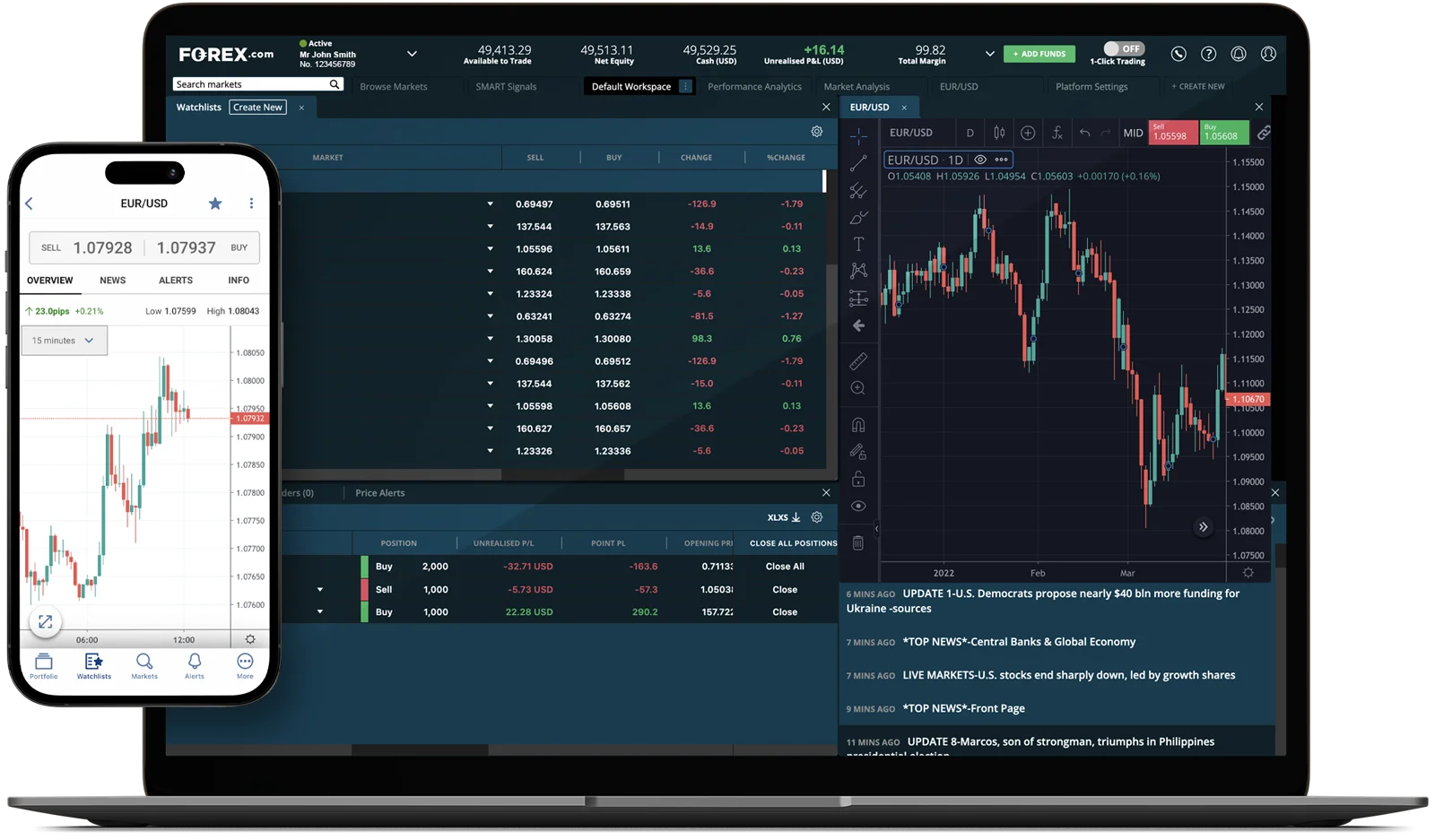

a. Technical Analysis

Leverage tools like charts, indicators, and historical data to predict price movements and identify entry/exit points.

Example: RSI and MACD indicators for momentum and trend analysis.

b. Fundamental Analysis

Analyze economic factors, company performance, and geopolitical events that influence market behavior.

Example: Understanding interest rate changes and their impact on currency pairs.

c. Risk-Reward Ratio

Calculate potential gains versus potential losses for every trade. A favorable ratio, like 2:1, ensures profits outweigh losses.

d. Diversification

Spread investments across multiple assets to reduce exposure to a single market or instrument.

- Currency Pairs

- Market Analysis Tools

- Trading Hours

- Customer Support

- Order Types

Cases are perfectly simple and easy to of choice and when nothing.

- 40+ Forex pairs

- Deposit: USD, EUR, GBP, JPY

- Trading Central

Real-time market news, technical analysis, and trading signals.

- 40+ Forex pairs

- Deposit: USD, EUR, GBP, JPY

- Trading Central

24/5 trading across various markets with flexible hours.

- 40+ Forex pairs

- Deposit: USD, EUR, GBP, JPY

- Trading Central

24/7 customer service for all trading and account-related queries.

- 40+ Forex pairs

- Deposit: USD, EUR, GBP, JPY

- Trading Central

Multiple order types, including market, limit, and stop orders for optimal trading strategies.

- 40+ Forex pairs

- Deposit: USD, EUR, GBP, JPY

- Trading Central

Best Practices in Risk Management

Set Stop-Loss Orders:

Limit your losses on individual trades to protect overall capital.

Maintain Proper Position Sizing:

Avoid over-leveraging by keeping trades within a small percentage of your total portfolio (e.g., 2% per trade).

Regularly Review Your Strategy:

Periodic evaluations help refine your approach based on performance and market conditions.

- 01

What is a stop-loss order?

- 02

How does diversification reduce risk?

Diversification involves spreading investments across various assets or markets, reducing the impact of a poor-performing trade.

- 03

Can risk management guarantee profits?

No, but it significantly reduces the likelihood of catastrophic losses and ensures disciplined trading.

- 04

How often should I analyze my trades?

Frequent analysis, ideally after every significant trade or weekly, ensures alignment with your trading goals.

- 05

What is the importance of a risk-reward ratio?

It measures potential profit against potential loss, helping traders focus on high-probability trades.

Conclusion

Risk management and analysis are the cornerstones of professional trading. By employing effective tools and strategies, traders can navigate market uncertainties with confidence, ensuring consistent performance and long-term growth. Always prioritize a disciplined approach to protect your investments while leveraging opportunities in the financial markets.