CFD Trading

What is CFDs Trading?

Understand the mechanics and advantages of trading CFDs

CFDs refers to the Contract for Difference. As the name suggest it implies a contract between buyer and seller which states that buyer will pay the seller the difference between current value of an assets and its value at the time of contract.

CFDs provide investors an opportunity to make good money from the price fluctuations without owning the particular assets. This is because the value of CFD contract doesn't consider the value of an assets instead it consider only the changes in the price from entry to exit.

Why one should go for CFDs Trading?

Trade Global Markets with Flexibility

CFDs trading refers to only the price difference, it allows you to trade with a small investment.

Profit from Market Ups and Downs

Round the clock access to global markets while trading in CFDs.

Access a World of Opportunities

CFDs trading brings an ample of variety such as stocks, Indices, Currencies, Commodities comprising more than 17000 instruments.

Leverage the Power of CFDs

CFDs refers to the price difference hence allow the investors to trade long or short depending upon their analysis.

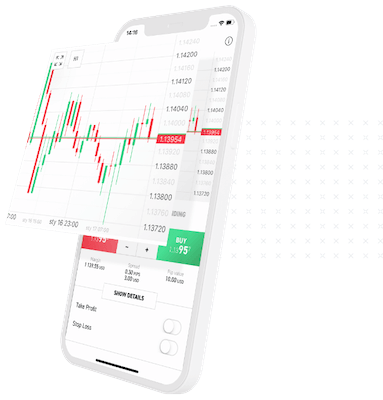

Dynamic Trading, Simplified.

CFDs trading leads the investors to a diversified financial cart balancing their portfolio and making good earnings.

Why Trade Index with FX Tray?

- Scale down the risk associated with our effective stop and limit orders.

- Our leverage offers you to get much larger trading exposure with only a fraction of capital.

- World's finest platform to start trading CFDs across the globe.

- FX Tray offers you expertise in CFDs with round the clock service.

- Get diversification option with FX Tray through variety of instruments available.